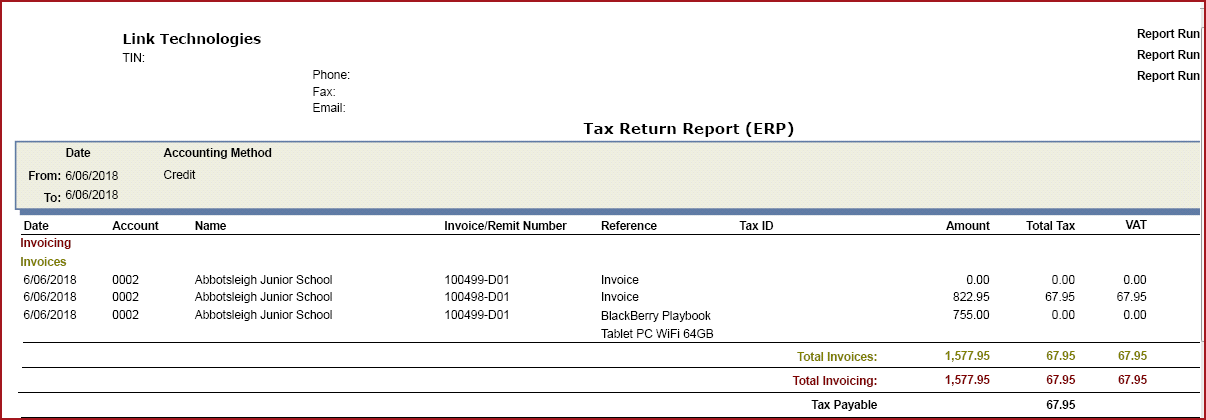

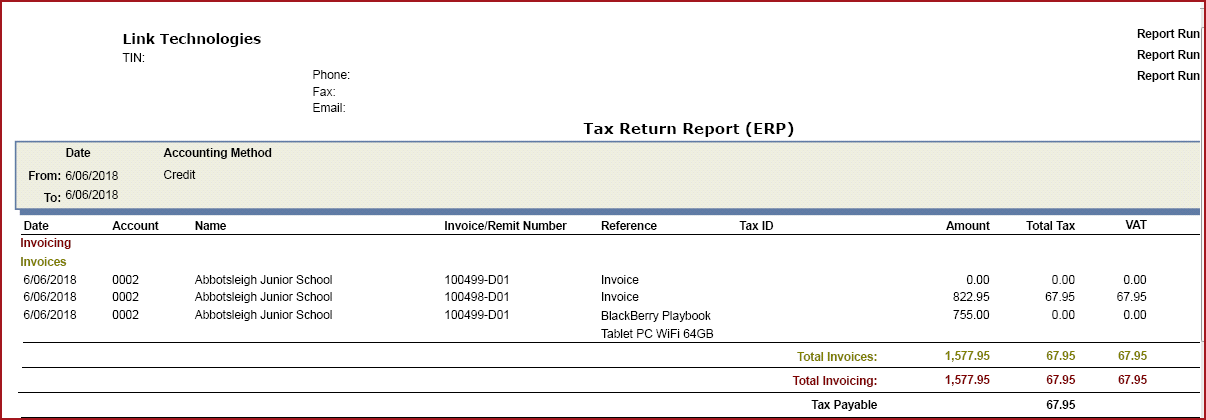

Tax

Return Report outlines the list of invoices and

payments with the VAT amount that has been collected or paid.

The report can be generated with the below filters:

-

Date

-

Accounting Method

-

Cash - Cash method will list all sales and payment transaction on

which cash has been received or paid in a particular period.

-

Accrual - Accrual method will list all sales

and payment transaction that has been invoiced in a particular period.

Notes:

-

Tax rates must be configured in FMS Portal for the

tax report to show data correctly. Setup rates under "Debtor -- Tax

Maintenance".

-

Values on the report is reflected on the "Fiji VAT Return Form".

Figure 1: Tax

Return Report

Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation  Link Technologies - LinkSOFT Documentation

Link Technologies - LinkSOFT Documentation